The Insurance is too damn high, here’s why, and how to stabilize the insurance market:

The case for Government Backed Catastrophic Perils Coverage

What is, or is not, insurable is very much a matter of perspective. The Insurance Industry largely washed its hands regarding pandemics being an insurable event, leaving non-essential businesses (whatever the hell that means) to fend for themselves if we ever experience a global shutdown again. How does one finance a new restaurant, cruise ship or theme park without access to business interruption insurance for the largest exposure in our lifetime?

That would be a bigger issue, except I don’t think we will ever shutdown like that again for anything less than a full-on Ebola outbreak or Walking Dead Scenario (triple knock-on wood). For the record, I said shutting down might not be a great idea back in March 2020 because we were not being presented with the Total Cost of Risk. I think we learned that, while well intentioned, the cost of risk for that form of loss prevention was too high. Se-lä-vē, folks did the best they could with that they knew, and the planet quite literally has bigger fish to fry.

The problem is the insurance industry is washing its’ hands regarding the insurability of a great many things, pandemics, wildfires, landslides, cyber, Florida, Louisiana, California, (disturbingly) LGBTQ Pride events and, in a final insult, the Gilory Garlic Festival. U.S. Core Inflation is coming down; however, key takeaways from The Council of Insurance Agents & Brokers’ Commercial Property/Casualty Market Report for Q1, 2023 show the 22nd consecutive quarter of premium increases, at 8.8%, well above the Federal Reserve’s 2% target for inflation.

Insurance markets are broken. My homeowner’s insurance, in weather benign central Indiana, is up 15%, with no losses and a $2,500 deductible. And I consider myself lucky, very lucky. My rate increase is the insurance industry attempting to spread its climate risk across other policyholders. It’ll never be enough, and insurers are running out of policyholders who aren’t having widespread, catastrophic losses.

As less fortunate policyholders across the country see their insurer cancel coverage and flee their state faster than the Indianapolis Colts left Baltimore, Emily Flitter of the New York Times, and others, say this is a “crisis with no easy fix”. However, much of her article centers around the inability of insurers to charge a rate that is commensurate with the risk they are being asked to insure. That is 100% true, insurers in catastrophe prone areas are largely prevented by state regulations from raising their rates quickly, or adequately, enough to respond to rising CAT losses. However, proposed solutions like Daniel Schwarcz’s, of the University of Minnesota Law School, to “let insurers charge whatever they want to for policies in disaster-prone areas” are flawed because they largely focus on spreading Florida’s problems across Florida policyholders.

Climate change is like BBQ, accept not awesome; your region’s flavor only impacts you and largely no one else. The folks who love Memphis BBQ the most live in Memphis, and the only people who want coverage for landslides are in landslide prone areas. This means there are no clean risks, i.e., me in Indiana, in which to spread the risk, and thus more people in the pool are likely to have a landslide loss at the same time. It’s called adverse selection, and it makes insurance pooling breakdown.

One of the first things I discovered in corporate risk management, is whatever terrible risk we needed insurance for the most typically had the least amount of capacity available in the market, assuming it was affordable, or coverage was available at all. That is because it is very difficult to spread large, unpredictable, risks with adverse selection via traditional insurance markets. Many large corporations and entities end up self-insuring these risks via captive insurance companies and other alternative risk financing methods. It used to be that regular insurance companies could still handle these terrible risks for the rest of us because our individual loss exposures weren’t too catastrophic, correlated, or unpredictable. However, if the industry can’t even find a way to insure the Gilroy Garlic Festival that’s obviously not working anymore.

Consider how many different types of catastrophic risk are destabilizing very specific areas of the insurance market right now; Pandemic(s), e.g., Human, Avian, Swine (there is a lot more than COVID19 and Monkey Pox to be worried about), Wildfire, Ransomware and Social Engineering, Florida Condo Collapse, Nuclear Verdicts, Nuclear Putin, The Insurance Industry is supposed to be the relief valve for excess risk in the economy. If our industry cannot find a way to participate in spreading the new mega risks of our time, they will lose the right to profit from insuring those “easy” or predictable risks that remain.

There are three ways to spread risk; across policyholders, across time AND across other risks. The insurance industry’s response to pandemics, climate change, and the other major risks of our day, has largely been to focus on their inability to spread these risks across time and/or other policyholders. What about other risks? Does the key to the Insurance Industry’s future lie in its past, and how volcanic eruptions are insured? More on that later….

First, Risk Mangers do not like hearing that something is uninsurable, and we have a long tradition of using captive insurance companies and other creative risk financing vehicles whenever we have the Means, Motive and Opportunity to bypass buying insurance. New technology, often referred to as “InsurTech”, has dramatically lowered the bar to creating new forms of insurance, and insurance companies – There are new MEANS to do this, and it is a lot easier to standup a brand-new insurance company than legacy insurers may realize.

My concern is the Insurance Industry’s stance that all these CAT risks are uninsurable is giving Risk Managers the MOTIVE to use InsurTech and Alternative Risk Transfer (ART) vehicles to cannibalize traditional insurance markets as fast as they can. Risk Managers have been utilizing ART vehicles, like captive insurance companies, to manage large, complex, and bespoke risks, and create new insurance solutions more nimbly than traditional insurers, for decades. Surprise! The companies who possess the telematic, artificial intelligence, and IoT data needed to revolutionize the insurance industry may decide it is easier to simply become the House, rather than partner with it. Isn’t it always better to be The House when gambling? At what point does an original equipment manufacturer with increasingly large amounts of telematic and/or IoT data decide it is more profitable to become an insurance company? Selling 3rd party general liability and/or workers’ compensation insurance to customers and suppliers means you can now sell yourself tax deductible (self) insurance for pandemic business interruption, cyber or certain impacts from climate change. Why wouldn’t Risk Managers do this? Indeed, many are being forced to, and the answer is it would be better for the Insurance Industry to fix the market than find out what happens if this continues.

So how can we stabilize insurance markets? At the start of the pandemic shutdown, I tried to raise the alarm in Risk & Insurance that massive economic pain was coming and encouraged Congress to get ahead of it by indemnifying those impacted by shutdown via a Pandemic Risk Insurance Act, like what was done for terrorism after 9/11. I talked with many folks in Government during my Mr. Smith Goes to Washington 15 minutes, who all largely told me that Congress would do whatever the Insurance Industry uniformly agreed was a good idea. More than one lawmaker said “The insurance industry’s problem is they don’t speak with one voice, to Congress, like Wall Street. They speak with many voices, with many divergent interests, largely to the state legislatures who regulate them.”

During the pandemic it seemed folks in the Insurance Industry became increasingly worried about the industry’s ability to pay for losses, and unfairly getting stuck with the bill. Those were, and are legitimate concerns; however, this was the world’s largest uninsured business interruption claim. There needed to be controls over who got indemnified and instead of stepping up, the insurance industry walked away. That’s why my retired dad got stimulus to do nothing while my favorite pizza place went out of business. Indeed, why is it that Innovation Refunds is getting paid 15% on over $5,000,000,000 in Payroll Tax Credits and the insurance industry must always worry about getting a bill. Seriously, every American has essentially paid the founder of Innovation Refunds $3 to process Employee Retention Tax Credit claims. I am sure Howard Mackler is a wonderful person; however, did we all really need to pay him $3 for something the insurance industry could have used its claim adjusting infrastructure to do much more cost efficiently? Like stupid cheaper than that….

Why couldn’t the Insurance Industry have demanded to get paid and handle claims like we do for Crop Insurance? Every year, approved insurance providers enter into a contract called the Standard Reinsurance Agreement (SRA) with the Federal Crop Insurance Corporation (FCIC) to administer the Crop Insurance program by marketing, underwriting, and adjusting claims for Crop Insurance policies. I think we all know Congress went a different way with the pandemic, and we have all been paying the price, literally, for everything.

I was taught by many very smart insurance professors that nothing is truly uninsurable unless it is illegal. Is the Insurance Industry the Masters of Risk or not? Take a minute and imagine a world where everyone had business interruption insurance for COVID and forget about who was paying for it. The Government spent $4.6 Trillion in total budgetary resources for COVID19 as of 4/30/22. Would it still have been that much if we paid losses via business interruption insurance? I know we would not have paid my dad’s lazy butt multiple times (love ya pops).

How do you insure pandemics, terrorism, and the impacts of climate change? We’ve solved this before and just need to go Back to the Future and consider how the Basic Perils Cause of Loss Form solves “Volcanic Action” Insurability.

You could never stand up an insurance company to insure only homes subject to volcanic action, as the only people who would buy coverage live under a volcano. You also never know how frequently or when an eruption is going to occur, and that makes it a very hard exposure to reserve for. Instead, we just threw it in with the other 10 basic perils. If you want your fire,

windstorm, lightning, etc. coverage in Indiana, you get charged a few bucks for volcanic action coverage you’ll never use, and the pool works for our friends under Mount Saint Helens.

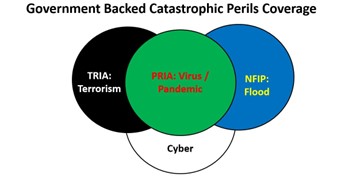

I believe the insurance industry needs to take a similar approach for the new mega risk of our time and kill the All-Risk (Special) Cause of Loss Form in favor of a Government Backed Catastrophic Perils Coverage Form. As one of my mentors, Gary Henriott would say, “The All-Risk Cause of Loss Form keeps getting the insurance industry into trouble, get rid of it. It is a promise that is too often litigated”. Gary and I are in favor of a Government Backed Catastrophic Perils Coverage Form because it spreads tough risks across other exposures to create a portfolio effect and “soft” coverage mandate.

I (largely) advise clients NOT to elect TRIA Coverage in Indiana, if there is no exposure. However, is it fair for Hoosiers to visit and benefit economically from NYC when we don’t elect TRIA? I think you spread terrorism, pandemic, flood, wildfire, etc. risk by creating a portfolio of Federal Government backed catastrophic perils. And Cyber; let’s get ahead of one of these Black Swan events for a change. Are you an essential business in a flood zone with limited terrorism exposure? With the insurance industry / Government backed Catastrophic Perils coverage form, when the bank mandates you buy flood Insurance you have to kick in for terrorism, cyber, pandemics, and all the rest. In the Freedom Tower in New York? When your landlord mandates you buy TRIA for terrorism, you’ll now be kicking in a little for Flood, Cyber & Pandemics.

After many great conversations with many great insurance and risk management minds, this is the plan that I think can restore order to insurance markets and help heal the broader economy. I believe this plan has the lowest total cost of risk for America. It utilizes the portfolio effect and creates a soft mandate to bring more insureds into the risk pool. This is a plan where the insurance industry can pay all the loss, none of the loss, or split something in between with the Federal Government. The important thing is that we never let Congress violate the Principle of Indemnity again.

WSJ – Home Insurers Curb Policies in Risky Areas Nationally: Home Insurers Curb New Policies in Risky Areas Nationally Fortune – The cost of cybersecurity insurance is soaring and state backed attacks will be harder to cover: The cost of cybersecurity insurance is soaring–and state-backed attacks will be harder to cover New York Times – Insurer’s retreat in Florida signal crisis with no easy fix: Insurer’s Retreat in Florida Signals Crisis With No Easy Fix Gilory Dispatch – Insurance remains a hurdle for Gilroy Garlic Festival: Insurance remains hurdle for Gilroy Garlic Festival Fox business – more insurance companies pull out of Louisiana: More insurance companies pull out of Louisiana: ‘We are in a crisis’ New York Times – State Farm Stops Offering Insurance in California: State Farm Stops Offering Insurance in California KQED – Pride Events See Rising Insurance Costs in Wake of Anti-LBGTQ Sentiment: Pride Events See Rising Insurance Costs In Wake Of Anti-LBGTQ Sentiment The Council of Insurance Agents & Brokers’ Commercial Property/Casualty Market Report for Q1, 2023 News Release: The Council’s Q1 2023 P/C Market Survey Shows Signs of Stabilization in Cyber Line with Spike in Commercial Property Premiums – The Council of Insurance Agents & Brokers (ciab.com) Ending Public Utility Style Rate Regulation in Insurance by Daniel Schwarcz :: SSRN

| By: Zachary Finn Zachary S. Finn, MSM, AINS, ARM, HACCP is the Chief Risk Officer and Director of Risk Management & Crisis Response at Henriott. Zach can be reached at zfinn@henriott.com |

About Henriott Group

Henriott is an independent Risk Management firm dedicated to helping clients prevent, manage, and recover from critical incidents. Working in both public and private entities through effective risk management, risk financing, commercial insurance, employee benefits, human resources, crisis management, contingency planning, and crisis response.

CONTACT

Grace Pritchett, Communications (765) 838-8610 | gpritchett@henriott.com