Henriott Group + Illuminate Advisers

Henriott Group is proud to welcome Chad Burdo to the team along with Illuminate Advisers. Henriott Group is a full service insurance and risk management firm that has acquired Illuminate Advisers, a niche Employee & Benefits risk management firm focused on strategic benefits planning for large employer groups. Founder and CEO, Chad Burdo has joined Henriott Group and will focus on widening the reach of risk management techniques to existing, as well as new, clients.

Zach Finn Joins Henriott Group

Henriott Group, Inc. is proud to announce and welcome Zachary Finn as the agency’s Director of Risk Management. Zach will be responsible for risk management client education, industry vertical risk management solutions, client engagement, and making sophisticated risk management more mainstream.

Life Insurance – Do I Even Need it?

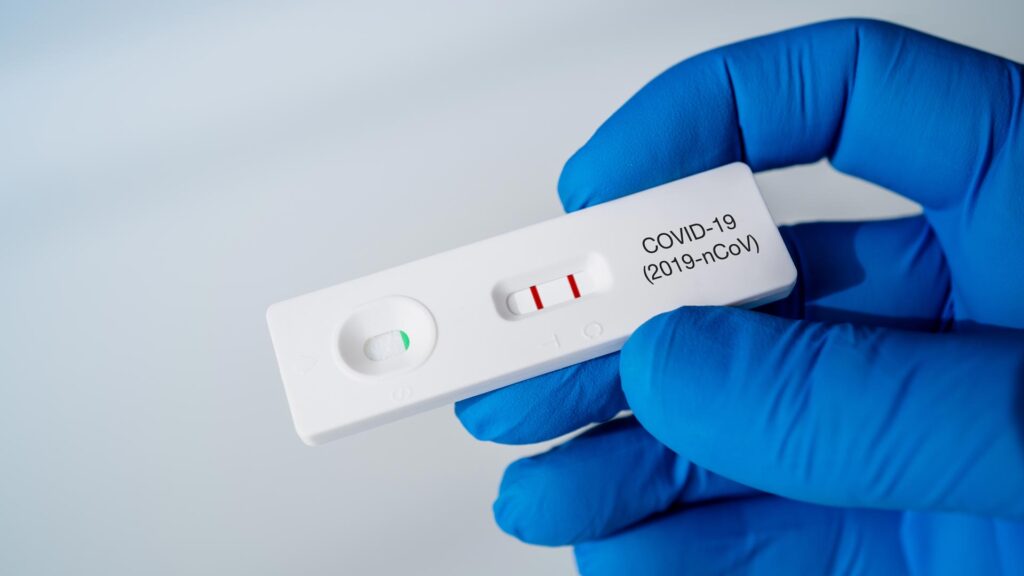

The Covid Pandemic has people buying life insurance with urgency. Industry statistics suggest that some Life Insurance Company’s business is up 50% during the month of March. People are realizing how many of their benefits are tied to their employment, which is fragile right now, and their health is potentially at risk. Seeking resolve looks different for every family.

Client Focused. Results Driven.

There is nothing that our Team at Henriott Group enjoys any more than telling our clients, in a time of need, that their claim is covered by their insurance program. That is why we do what we do, hence our vision statement, to “Provide certainty in an uncertain world”. When we can share good news in difficult times, we are fulfilling our pledge to be Client Focused and Results Driven.

COVID-19 and Personal Insurance

Over the last month, we have all adapted in ways we wouldn’t have expected or planned. A couple of these adaptations may include working from home or picking up a delivery job to assist a local store or restaurant. If you can relate to one of these, did you know your home or auto insurance policy may need to be changed to cover these exposures?

“It’s not covered…”

Reading your insurance contact and not finding coverage for a loss- hearing from one of our insurance carrier partners that there is no coverage for your claim- relaying that unpleasant news to you, our client, is just about as bad as it gets for us. We are in the business of delivering good news- good results for our clients- not bad news.

COVID-19 Breaking Down the Game

The classification of your employees may very well change to survive the “shelter in place” and “social distancing” restrictions that require a business model change. For example your office worker or clerical employee is all of a sudden pinch hitting as a delivery person…the current class codes on your workers compensation policies may need to be amended.

Is the Insurance Industry at it Again? Part 1

Without getting into the weeds too deep, I thought I may be a good time to remind ourselves what insurance is and what it is not. So, let’s start with the basic idea- Insurance is the sharing of risk- the idea is that when events are unforeseen and accidental, the financially negative impact of those occurrences could be shared by all those that face similar exposure to the same kind of loss.

Your Benefits During COVID-19

Many of our employer companies are working quickly to keep their employees safe in response to the novel coronavirus outbreak. Employers and employees are concerned and looking for guidance and any resources available. Along with State and Federal government, health insurance and ancillary benefit carriers are reacting to needs and providing support to clients and insured members.

Risk Management & Coronavirus

Appropriately so, you can’t turn anywhere without being confronted by this new threat to our personal well being as well as to our economic well being. We are being advised by the CDC, our state and local governments and our industry trade groups to do all we can to contain the spread of this virus. The virus is doing exactly what that virus should do but are we?